Another Net-Net Trainwreck

This one's the kind of stock the market smoked like a Camel Crush then flicked into the gutter.

Tiny. Illiquid. Cyclical. Retail-exposed. More or less everything has gone wrong in the exact way that makes investors hit “sell” and never open another filing. That’s how you get a “net-net” that stays a net-net: nobody wants to touch it, and insiders don’t own enough stock to feel shame.

The setup is basically this: the operating business is messy and volatile (sometimes outright awful), but the balance sheet and hard assets are what keep pulling value investors back like a possum to the dumpster behind Olive Garden.

At $1.70 per share, the company has a market cap of just under $6 million.

Maybe at this price, we’re getting a cigarette butt for free.

You’ll feel dirty just thinking about buying it. But it’s so cheap…

Jewett-Cameron: What this Company Actually Does

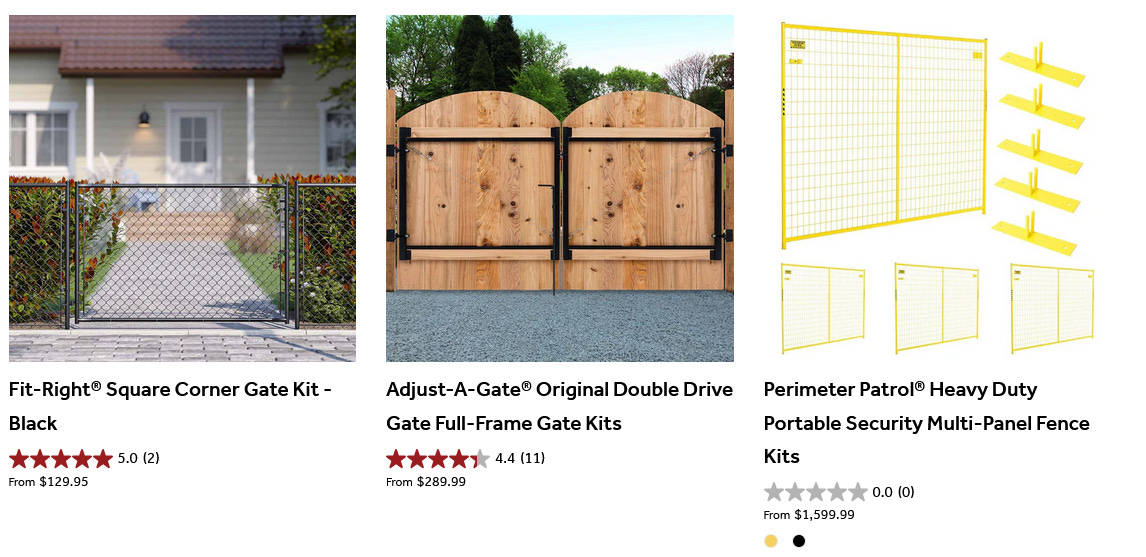

At its core, this is a low-margin importer and distributor of fencing, gates, pet enclosures, and industrial wood products, sold through big-box retailers, farm & ranch channels, and industrial customers. Think: things people buy when housing, DIY, and light industrial demand are healthy — and immediately stop buying when things tighten.

It’s inventory-heavy, cyclical, and brutally exposed to demand timing. When volumes are right, it muddles through. When volumes are wrong, working capital explodes, margins evaporate, and the income statement looks like it was dropped down a flight of stairs.

This is not a business you buy for quality.

It’s a business you tolerate only because the assets underneath it matter more than the earnings above it.

Which brings us to liquidation.

If this thing shut the doors tomorrow, how much cash would I get back after everyone else gets paid?

Using recent balance sheet ranges discussed in multiple value writeups (and consistent with filings), Jewett-Cameron roughly has:

Cash & equivalents: $1 million

Accounts receivable: $3.3 million

Inventory: $13.5 million

Other current assets: $1.3 million

Bank debt: $4.2 million

Other liabilities: $2.2 million

Before any owned real estate, that’s $12.7 million in net current asset value.

The Real Estate is the Kicker

Jewett-Cameron owns 109,500 square foot industrial real estate in Hillsboro, Oregon, which management has listed for sale with an asking price of $7.2 million. It’s held for sale at about $900k, which is a joke.

Comparable industrial land/buildings in that area trade well north of that, even in mediocre markets.

Haircut that to $5.0mm to be conservative.

Jewett-Cameron owns another ~2,000 square foot building they bought in 2010, renovated into an innovation center in 2020, and have recently listed for sale for around $800k. Let’s haircut that to $500k.

Then there’s the main headquarters, that sits on a 5.6-acre site in North Plains, OR — a logistics hub near Portland — with a 55k square foot warehouse and office.

Nothing super fancy, but between the owned land and building it should be worth easily another $4-5 million at $100/foot — maybe more.

Sum all that up, and we’re looking at $10 million in hidden real estate value against just a $6 million market cap.

Insider Ownership Is Low — Which Is Why This Has Dragged On

Management and the board own very little stock, which means the “right” outcome for shareholders (monetize assets, shrink the empire, stop the bleeding) is not automatically the right outcome for the people collecting paychecks.

That’s the classic microcap disease: shareholders want value realized; insiders want the company to continue existing.

The most important shareholder here isn’t some hotshot activist or a CEO with diamond hands. It’s the Oregon Community Foundation, sitting on roughly ~24% of the company. They’ve been dribbling out stock for months into stink bids. Which could be perfect for a big activist investor to scoop up a lot of shares for cheap.

Liquidation Won’t be Optional

Jewett-Cameron isn’t struggling along a cyclical bottom. It’s losing money fast enough that time is no longer its friend. Operating losses keep stacking up, working capital keeps getting trapped in inventory, and every quarter the business fails to generate enough cash to even pretend it can organically fix itself. You don’t grow out of this. You don’t optimize your way out of this. You just run out of runway.

With $4 million in debt and only $1 million of cash left, negative gross profit, and millions in overhead costs, Jewett-Cameron is stuck like a catfish on my grandpa’s fishing line.

At some point, it stops being about whether management wants to continue operating and starts being about whether the balance sheet and lenders will let them.

The lenders are the adults in the room, and adults don’t underwrite hope.

When cash flow is negative and losses are recurring, debt stops being “leverage” and starts being a countdown clock. The only reason financing exists at all is because there’s real collateral behind it — land, buildings, inventory — not because the operating business inspires confidence.

Banks don’t wait forever. They don’t need a press release. They just tighten terms, restrict flexibility, and quietly steer outcomes toward asset sales. When collateral is worth more than the business using it, liquidation becomes the cleanest solution — not the most dramatic one.

There are only three realistic paths from here, and they all point to the same place.

Either the board finally does the right thing and sells assets before more value gets burned.

Or the banks force their hand, one covenant and waiver at a time.

Or activists step in, because when a stock trades so far below its liquidation value for long enough, someone notices.

There is no fourth option where losses magically stop, demand rebounds perfectly, and debt quietly melts away. That path exists only in the delusions of overpaid management teams and goo-goo-eyed sell side analysts.

So What’s the Actual Bet?

The bull case is not “this is a wonderful business.” Don’t be ridiculous. It will probably never earn a positive ROE again.

It’s that Jewett-Cameron is about out of rope to hang itself with — and there’s enough trapped value that shareholders still get paid.

Based on current asset values, JCTC could fetch $20 million+ in proceeds between cash, working capital, and real estate after paying off all debts, or about $6/share.

Deduct whatever you want for taxes and fees — this is a fat pitch vs. JCTC’s current price of $1.70, representing over 200% upside.

This is the best newsletter name I have seen yet on Substack.

If you’re into researching super cheap companies that are burning cash and stuck with poor management, take a look at Retractable Technologies (RVP). I bet they would be right up your alley for coverage (if maybe not for the portfolio)